22.08.2024 / 08:00

Power Purchase Agreements for Utilities and Energy Producers

Energy Markets

Dive into the dynamic world of Power Purchase Agreements (PPAs) with our new PPA series. Each post will provide valuable insights as we decode the intricacies of PPAs.

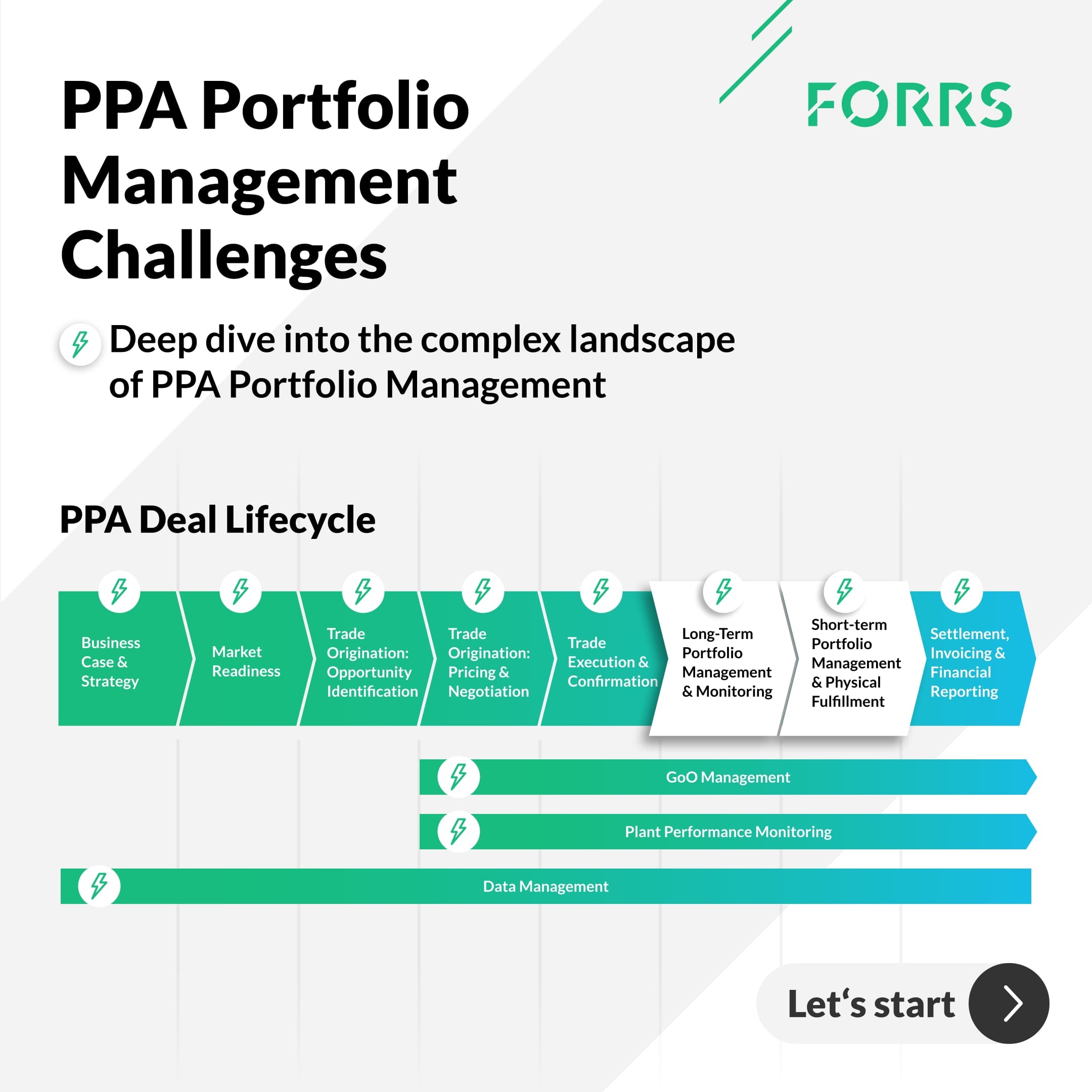

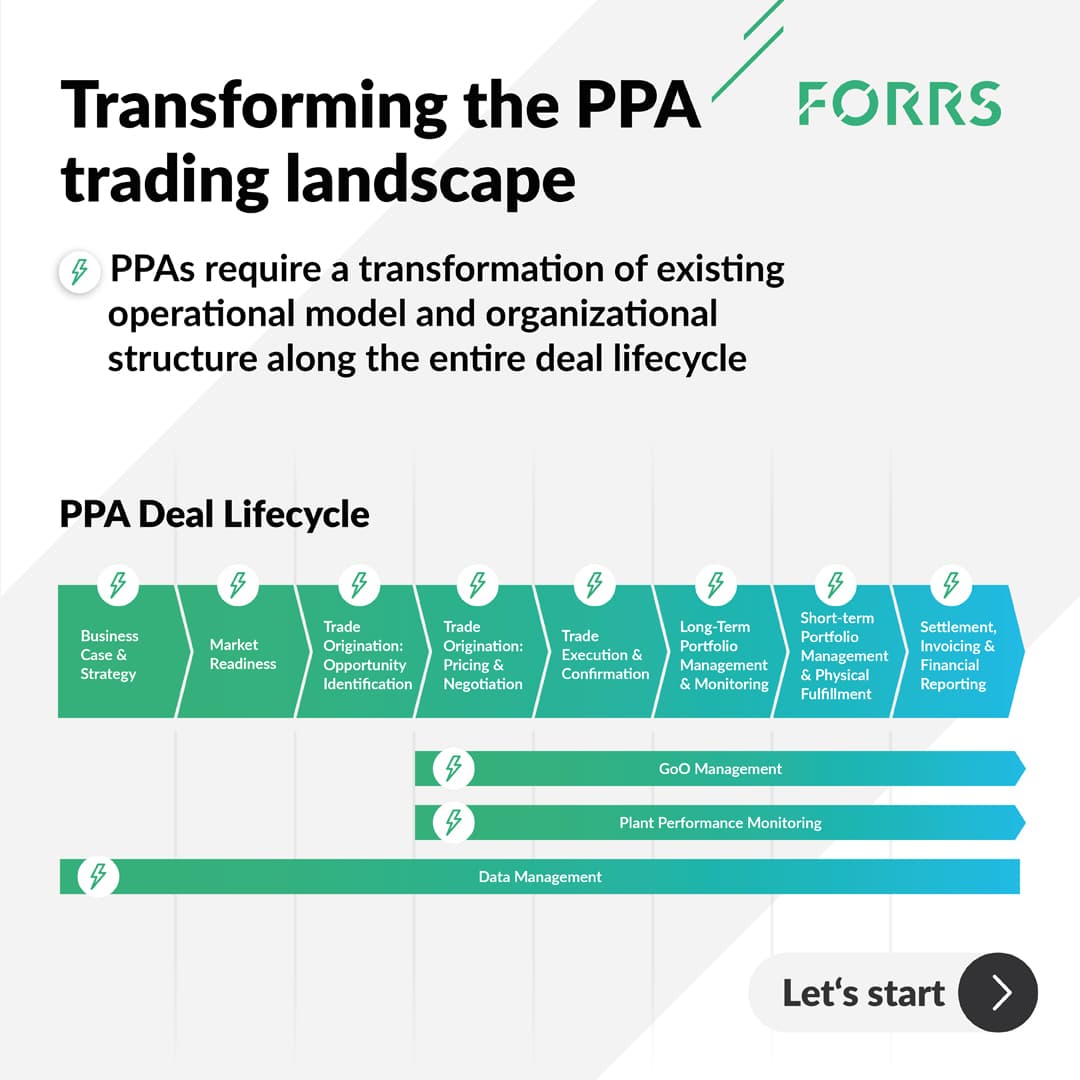

1. Deal-Lifecycle

PPAs are more than just agreements; they're strategic tools that align to the interests of different stakeholders:

- Corporations: Achieve sustainability goals and seamlessly integrate renewable energy into operations

- Investors: Secure your returns with the stability that PPAs offer

- Producers / Developers: Fuel your green projects with financial certainty

- Traders: Participate in the growing green energy market, aligning with global sustainability trends while maximizing your profitability

PPAs help everyone gain a competitive edge by navigating uncertainties and mitigating financial risk. 🌱💰 No wonder the demand for PPAs has reached unprecedented levels. 📈

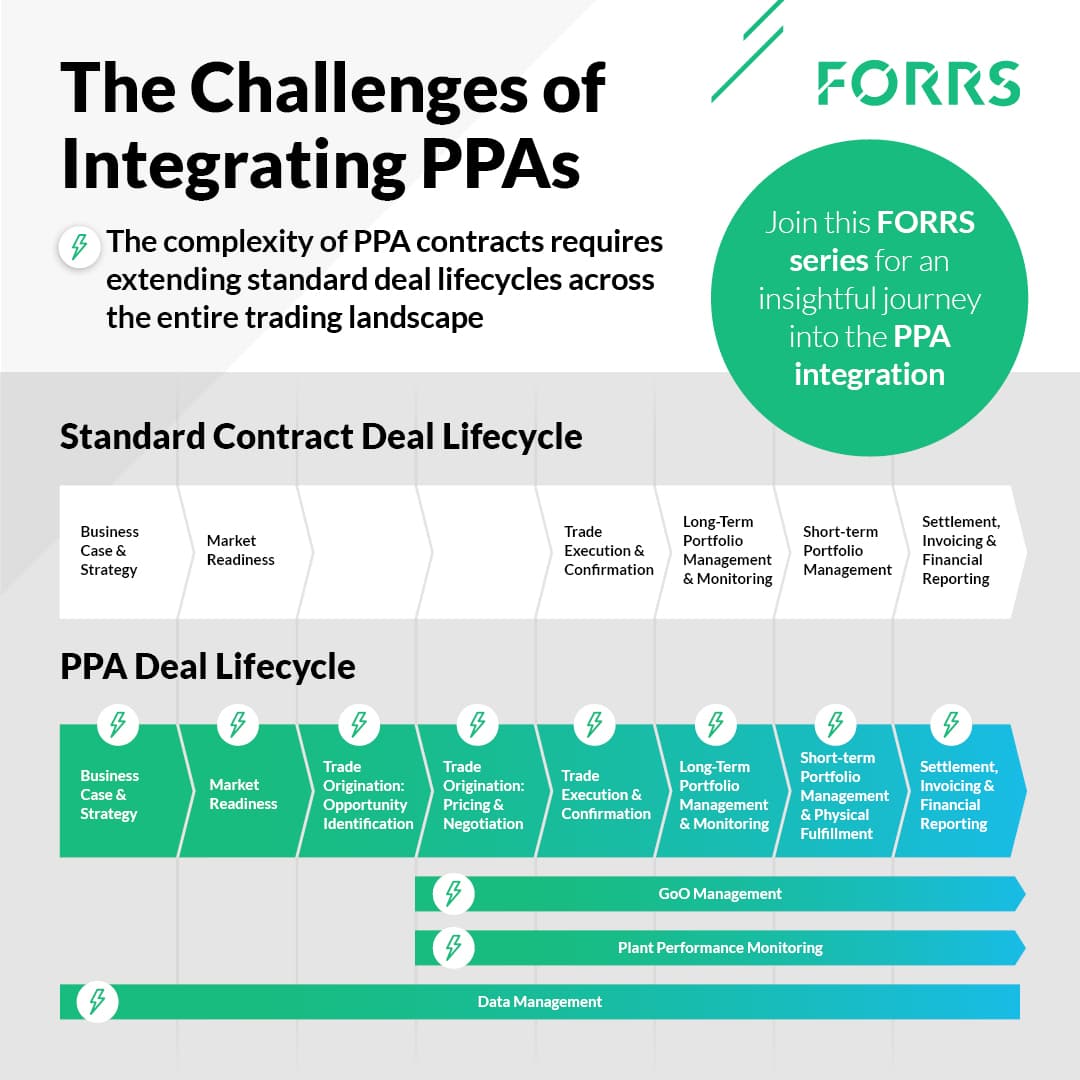

Given their bilateral and individual nature, PPAs often diverge from standard products, demanding adjustments within the existing trading landscape. In this upcoming PPA post series, we'll navigate through the complexities of this dynamic environment. We’ll delve into the challenges, risks, and potential hurdles faced by energy traders.

To kick off the series, our first post spotlights the high-level PPA deal lifecycle, outlining the extensions required, due to the distinctive nature of PPA contracts. Stay tuned for a deeper understanding of the challenges associated with PPA integration.

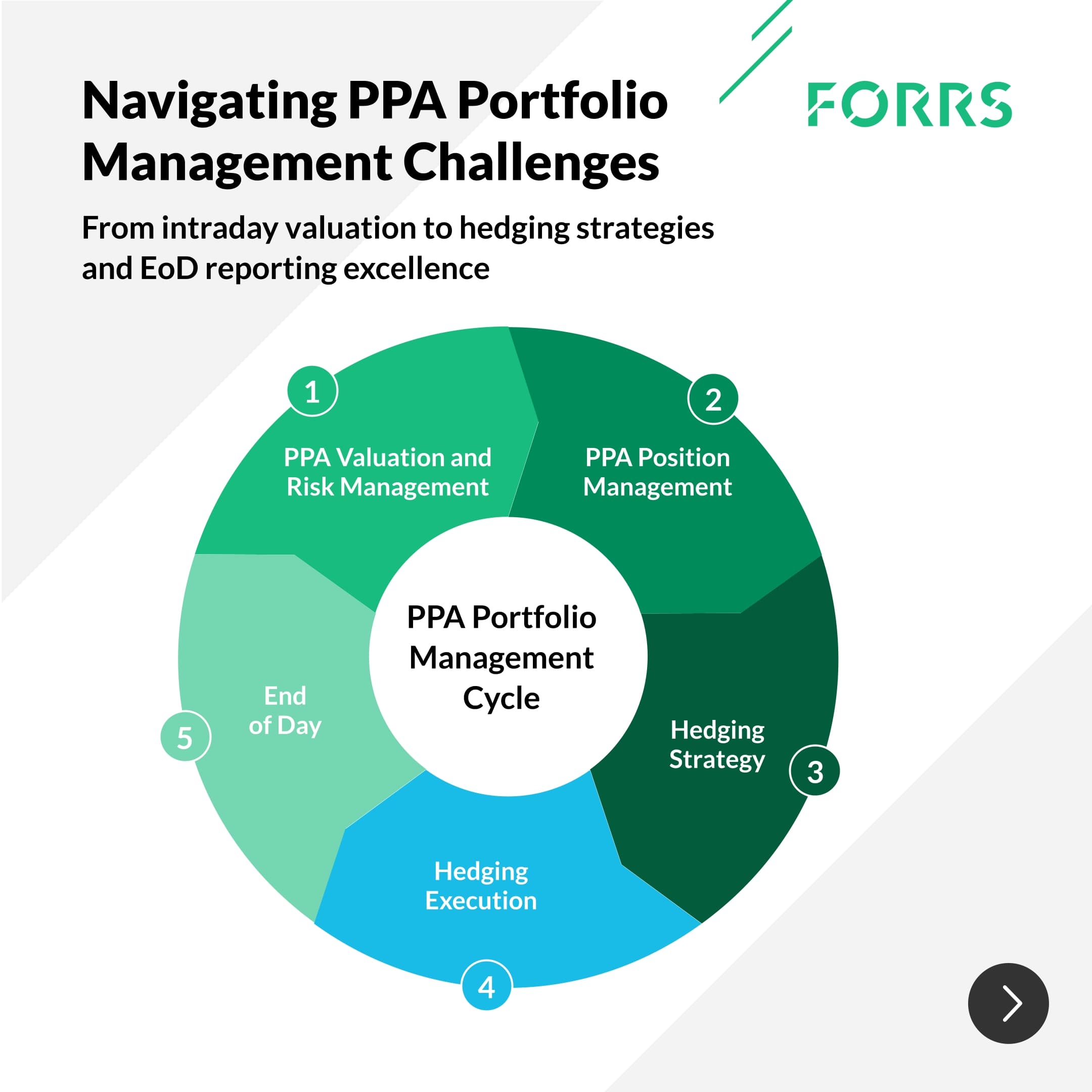

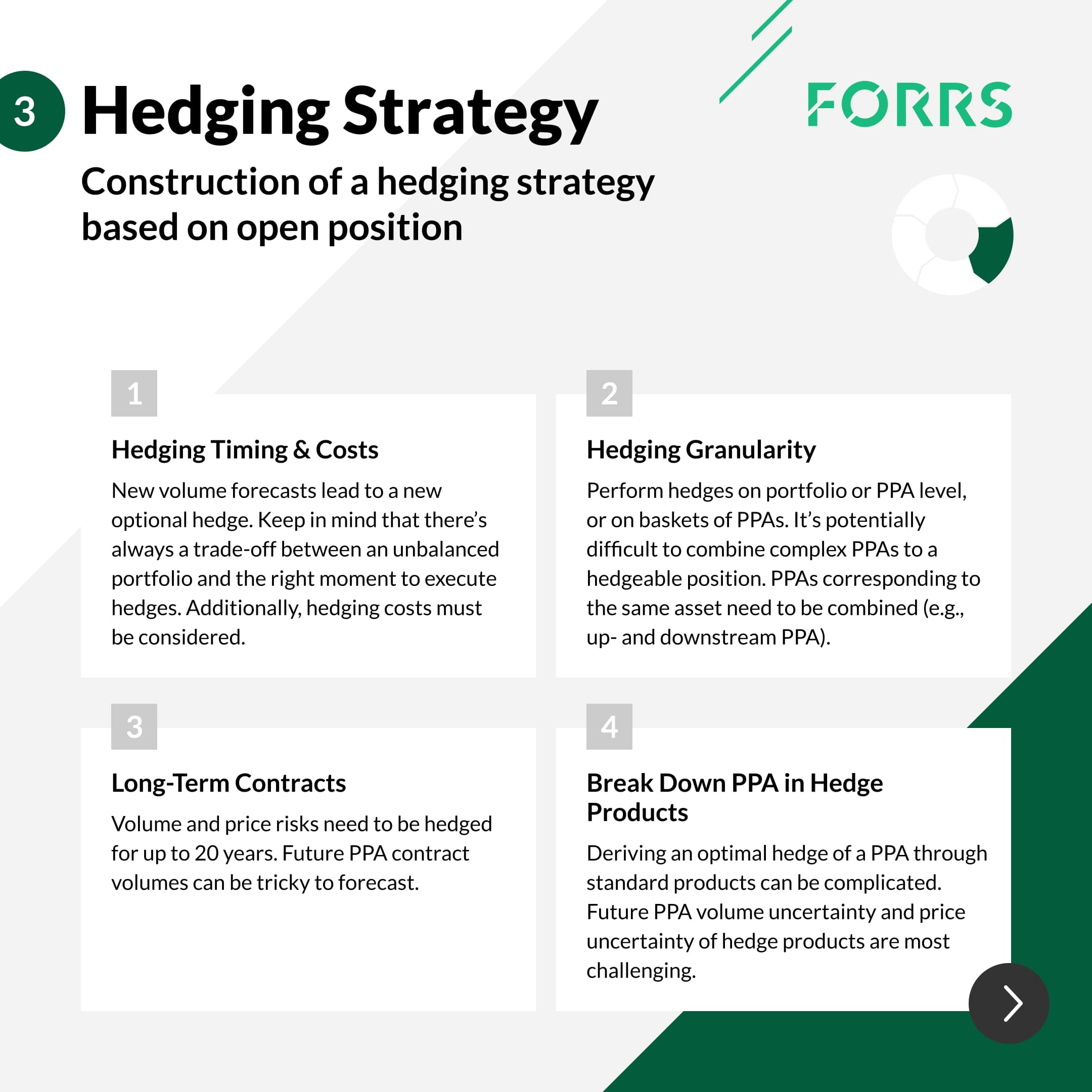

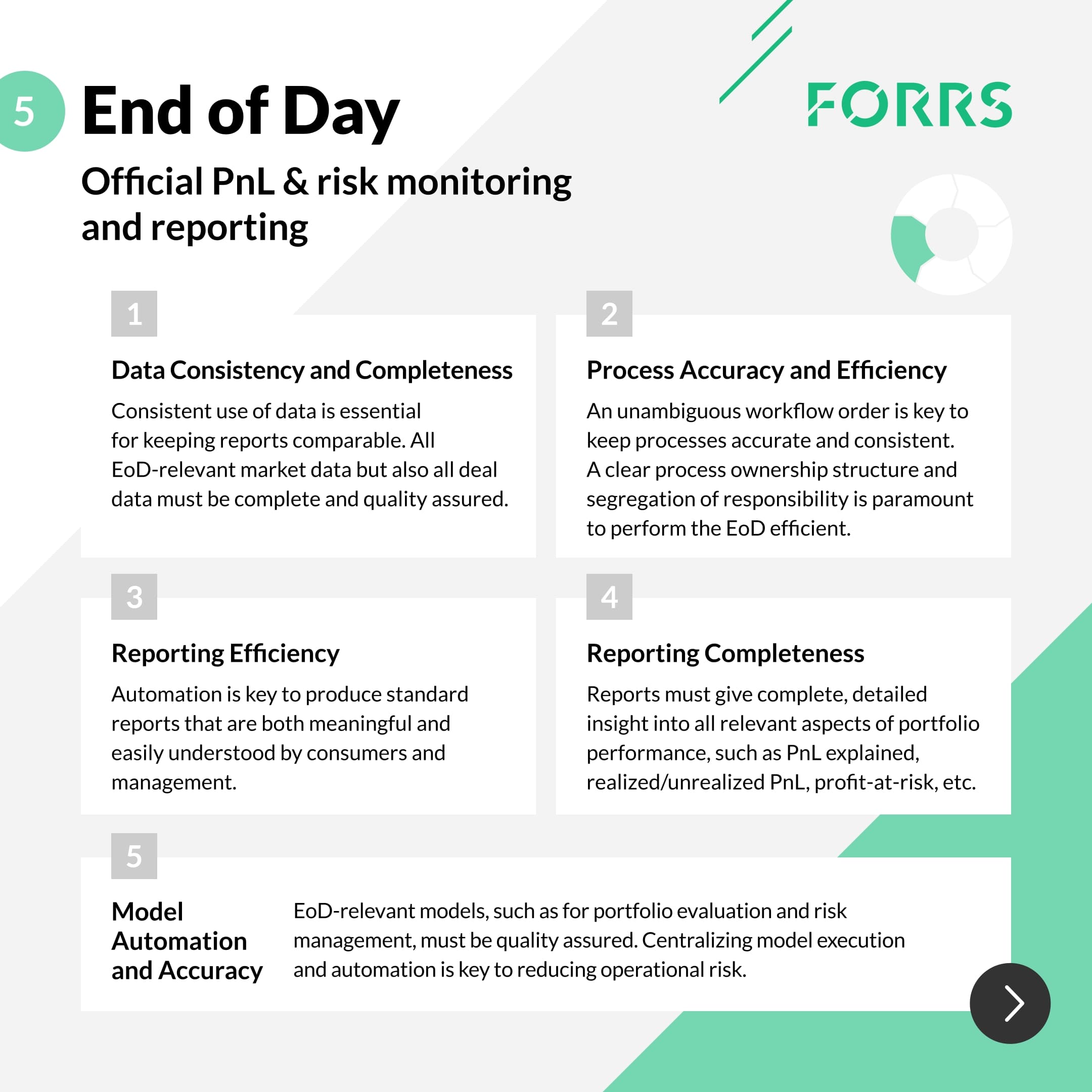

2. Trading and Portfolio

In this part, we take a deep dive into the intricate landscape of portfolio management, highlighting the challenges posed by PPAs. We'll unravel the complexities of the evaluation stage, navigate the processes of breaking PPAs into hedge products, and calculate their real-time positions and PnL impact.

Moving forward, we'll explore crafting a robust hedging strategy, executing these hedges with precision, and culminating the trading day with a comprehensive End-of-Day process to reevaluate our portfolio's performance. 🚀💼📉

All along the PPA portfolio management cycle, precisely measuring the implied risks of PPAs and hedges is vitally important to efficiently utilizing risk capital and to making the right trading decisions.

Challenges abound in every step of this PPA portfolio management cycle.

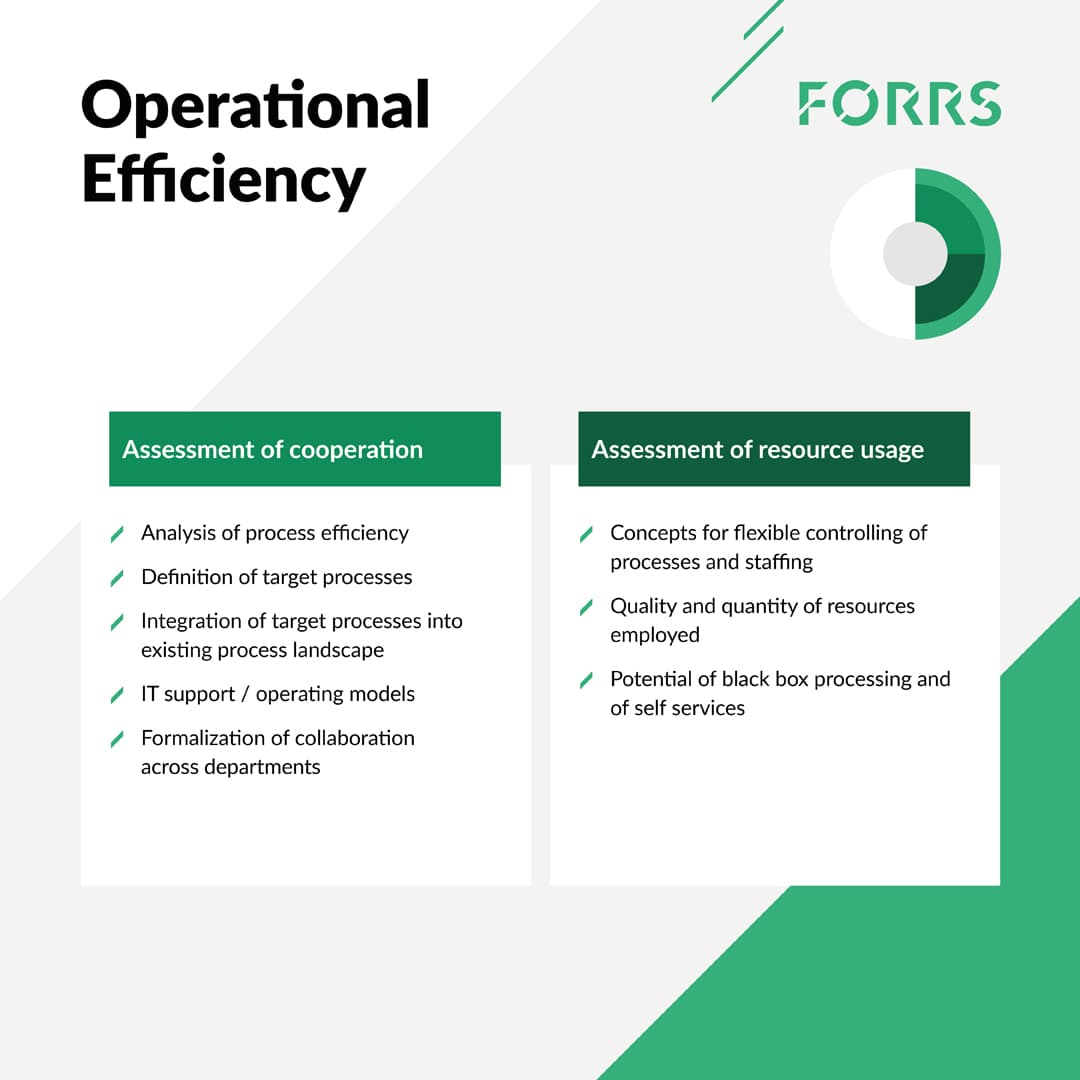

3. Target Operational Model

This time we focus on defining Target Operational Models (TOM). It enables extending an existing trading landscape or building a new trading landscape to manage PPAs.

What is a Target Operational Model (TOM) for PPAs?

Trading and managing PPAs within a trading organization requires a solid and robust foundation on an organizational and operational level. And the TOM provides an approach to get to that goal.

On an organizational level the TOM defines structures across Front-, Middle- and Back-Office, including all organizational capabilities that support the management of PPAs. It provides a comprehensive picture on required business units, including the segregation of responsibilities, trading functions and trading competencies.

On an operational level the TOM defines operational processes down to concrete operational tasks which must be performed to manage PPAs efficiently day by day. It even allows deriving required trading roles and concrete job profiles for hiring trading skills and expertise needed.

The TOM and the underlying approach is highly adoptable and scalable to encounter for required future changes.

The Target Operational Model (TOM) is a proven approach to manage and integrate PPAs

The starting point of the TOM’s underlying approach is based on industry standards and best practices for defining organizational structures and operational efficiency across Front-, Middle- and Back-Office. Since any trading organization is different – starting from strategy and down to operational processes – the TOM approach identifies the organizational and operational components required to integrate PPAs into an existing and given trading landscape. The result is a Target Operating Model highly customized to the specific needs and requirements of the trading organization in focus to manage PPAs efficiently.

Dive into our slides for more information on how the TOM approach can transform your organization with the goal of integrating PPAs into your trading landscape.

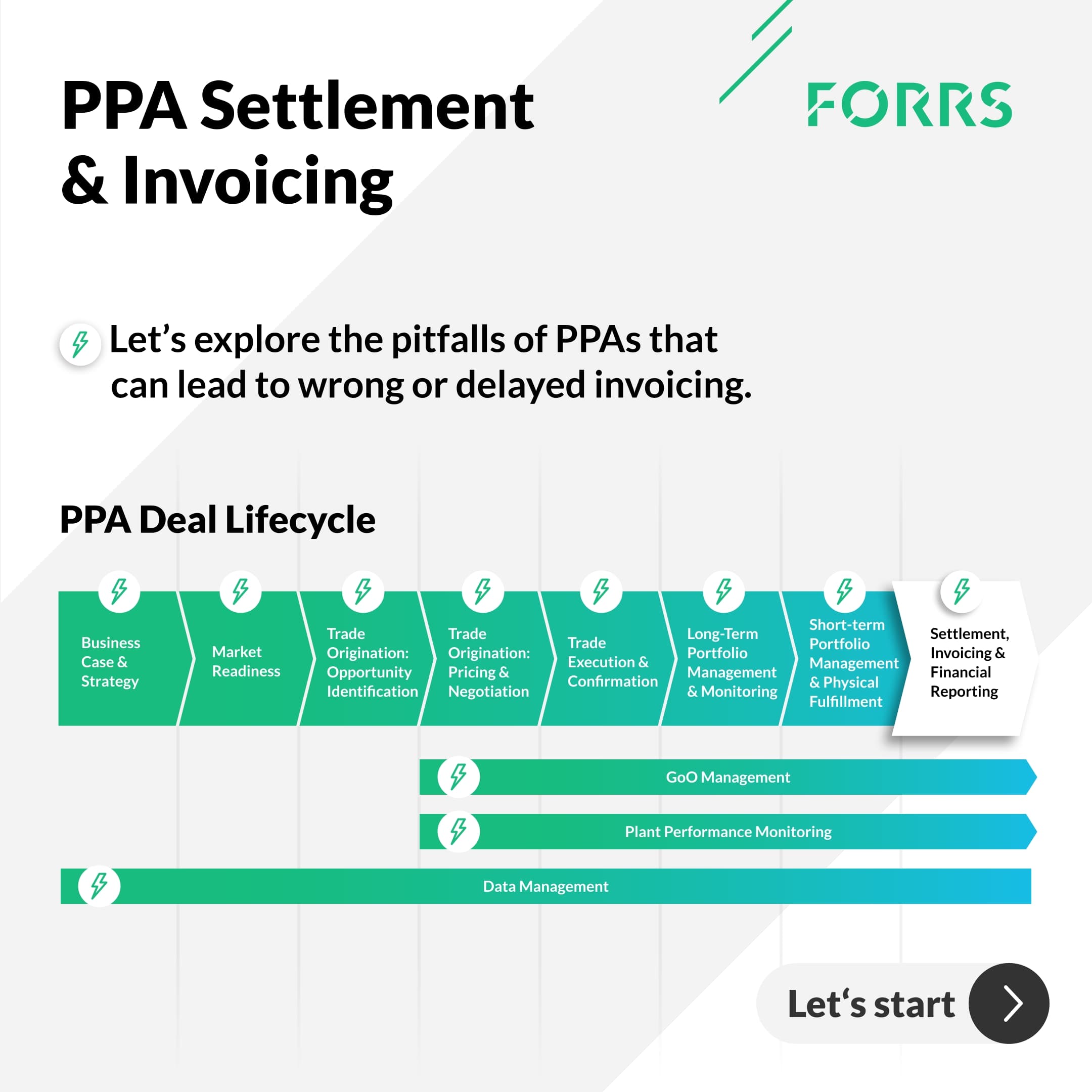

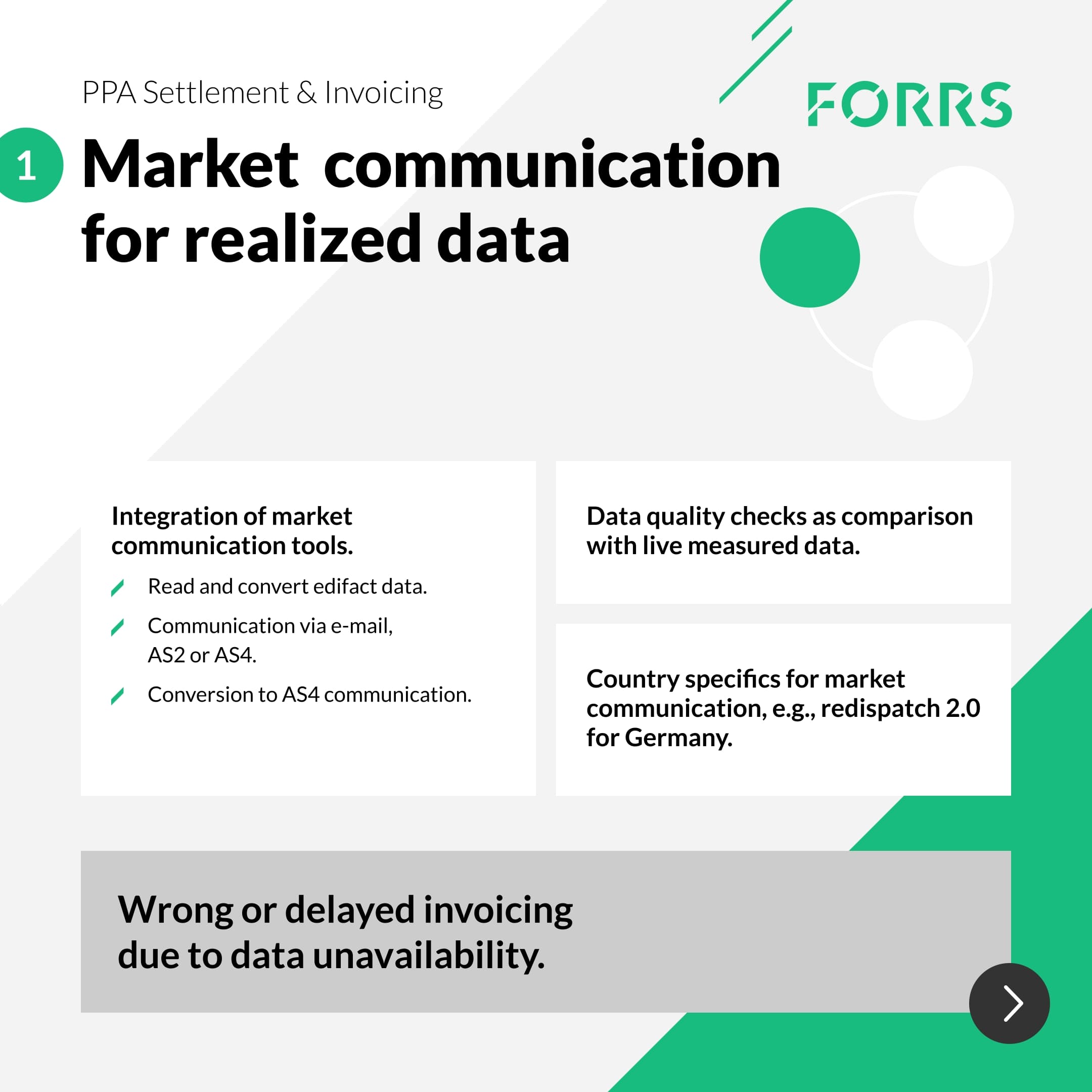

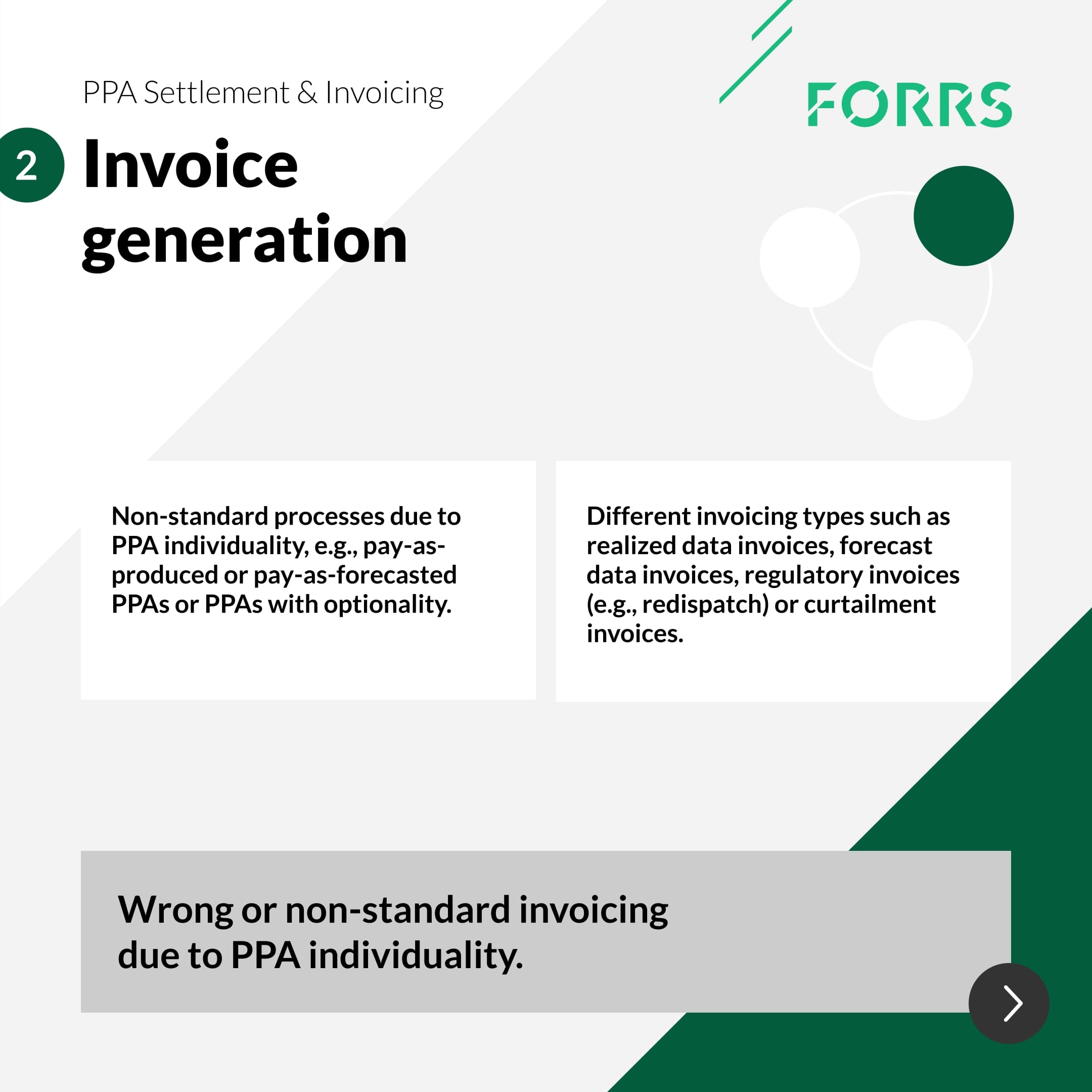

4. Invoicing And Settlement

Effective management of PPA Settlement and Invoicing processes necessitates a range of capabilities. In our post we concentrate on market communication for realized data, invoice generation, and regulatory capabilities. Let's explore the challenges that may arise in these areas.